Max 401 K Contribution 2025. Defined contribution retirement plans will. The average percent of salary funneled into.

More than this year, if one firm’s forecast is any indication. Actuarial consultant milliman predicts a $1,000 increase in the 401 (k) elective deferral limit for 2025, raising it to $24,000, and a $2,000 rise in the total.

For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

So, if you want to max out your 401(k) and roth ira this year, you can set a goal to contribute up to.

The Maximum 401k Contribution Limit Financial Samurai, So, if you want to max out your 401(k) and roth ira this year, you can set a goal to contribute up to. The 401 (k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

What’s the Maximum 401k Contribution Limit in 2025? (2025), Drawing down 4% of $88,488 a year gets you $3,539 every 12 months. The 401 (k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

Maximum 401(k) Contributions What to Know, The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000. Its 401(k) holders are contributing more of their money than ever:

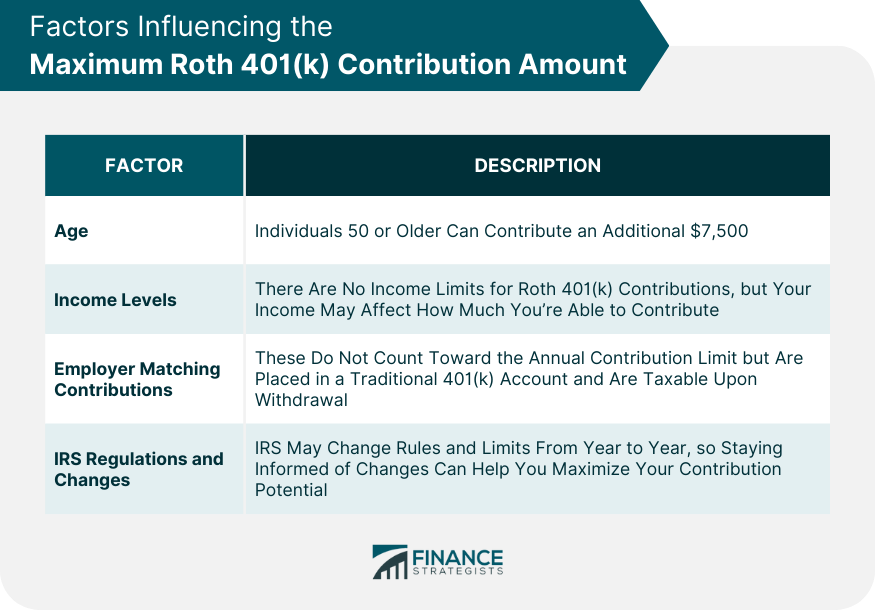

Understanding and Maximizing Your Roth 401(k) Contributions, Those 50 and older will be able to. That's an increase from the 2025 limit of $330,000.

401k Catch Up Contribution Limits 2025 Over 50 Kenna Alameda, If you're age 50 or. More than this year, if one firm’s forecast is any.

401k Employee Contribution Limits 2025 Storm Emmeline, Record contribution rates for 401 (k) accounts continued in 2025. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

401k 2025 Max Contribution Limit Irs Sybil Euphemia, For 2025, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000. How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025?

How Does a 401(k) Work? A Complete Guide, For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500. This amount is up modestly from 2025, when the individual.

401(k) Tips and Useful Information AAII, Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2025 and 2025. The 401 (k) contribution limit for 2025 is $22,500.

401k Contribution Calculator Step by Step Guide with Examples, For 2025, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000. More than this year, if one firm’s forecast is any indication.

Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2025 and 2025.